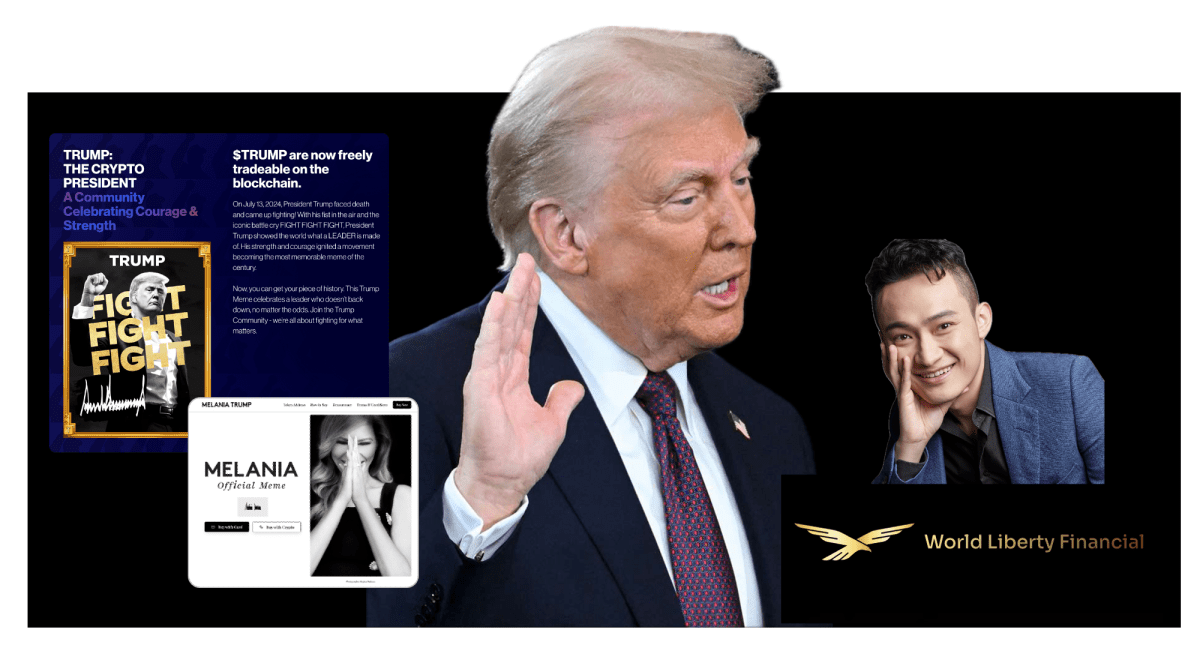

Trump’s crypto grifts: billions in paper profits, millions from memecoin trading fees, and new funding from Chinese-born entrepreneur Justin Sun

Grifter-in-Chief Donald Trump will not let an opportunity to profit pass him by.

This past Saturday, two days before the inauguration, Trump launched a new memecoin $Trump which generated up to $26 billion dollars in value for Trump based on the market price that day and the majority of tokens held by Trump entities. The next day the $Melania memecoin was launched. And on the day of the inauguration the Trump-supported crypto project World Liberty Financial, which Trump benefits from financially, received a second round of money from Chinese-born crypto entrepreneur Justin Sun.

New Trump Memecoins create billions in paper profit and millions in fees for Trump and his family

A few days before being sworn in as the 47th U.S. president, Trump surprised the public and the crypto world by launching a memecoin. The AP reported:

President-elect Donald Trump has launched a new cryptocurrency token that is soaring in value – and potentially boosting his net worth – just before his inauguration. It’s the latest norm-defying promotion by Trump, who has also helped sell branded bibles, gold sneakers and diamond-encrusted watches.

Crypto products are complex and complex products often provide opportunities for experts, insiders, and scam artists to profit off of less well-informed investors.

If anyone wondered if there would be guardrails around how flagrantly Trump enriches himself during the presidency – the launch of two memecoins right before the inauguration removes any doubt. Trump is going to milk every opportunity to enrich himself and his family – at the expense of the investing public and citizens he is supposed to be serving as the U.S. president.

I have been following Trump’s money and financial networks since 2016 and now that he is charging into the crypto world, I am following his new crypto deals with a focus on my niche area – the entities, people, and financial networks involved. I plan to leave the detailed coverage of how crypto works to the experts, but here is a brief description of memecoins for context.

Meme coins are a strange and highly volatile corner of the crypto industry that often start as a joke with no real value but can surge in price if enough people are willing to buy them. Dogecoin, the cryptocurrency whose mascot is a super-cute dog that muses things like “much wow,” is perhaps the most well known. Meme coins can be used by scammers looking to make a quick fortune at the expense of unwary investors.

Trump’s memecoin features the slogan “Fight, Fight, Fight” with a highly photoshopped image of a fit Trump pumping his fist in a gesture he made after the assassination attempt. The GetTrumpMemes website includes this disclosure about the memes and a description of the Trump entities that receive the revenue:

Trump Memes are intended to function as an expression of support for, and engagement with, the ideals and beliefs embodied by the symbol “$TRUMP” and the associated artwork, and are not intended to be, or to be the subject of, an investment opportunity, investment contract, or security of any type. GetTrumpMemes.com is not political and has nothing to do with any political campaign or any political office or governmental agency. CIC Digital LLC, an affiliate of The Trump Organization, and Fight Fight Fight LLC collectively own 80% of the Trump Cards, subject to a 3-year unlocking schedule. CIC Digital LLC and Celebration Cards LLC, the owners of Fight Fight Fight LLC, will receive trading revenue derived from trading activities of Trump Meme Cards.

The day after launching $Trump and the day before the inauguration, Donald Trump and Melania Trump announced on social media the launch of another memecoin $Melania.

Trump may have increased his net worth (on paper) by tens of billions of dollars from memecoins and has likely earned tens of millions in real profit through fees

It is not yet clear how much profit Trump could make from the recently launched memecoins. Trump entities reportedly own 80% of the tokens and early reporting estimated that Trump had approximately $26 billion in paper value based on the price of the tokens that were publicly trading. However, the price can drop significantly reducing the value held by Trump entities over time.

In addition to holding a large majority of the memecoins, Trump’s team is separately making tens of millions of dollars from the trading fees alone. The New York Times recently reported:

Conor Grogan, a director at Coinbase, one of the largest trading platforms in the United States, estimated in a social media post that as of Saturday, the Trump team had made $58 million in fees from all of the $Trump sales — even without selling its own reserve of tokens to the open marketplace.

The New York Times also reported that “the Trump team may be transferring some of its tokens onto an overseas trading platform called Bybit, which is not allowed to execute trades in the United States. Bybit has recently been the focus of enforcement actions by international cryptocurrency regulators.”

Could Trump earn trillions of dollars from his crypto deals?

In a rather stunning article CoinDesk reports that the Trump entourage holds $2.3 trillion in Memecoins and that “On-chain data shows that wallets likely controlled by members of Trump’s entourage have absurd paper holdings.”

According to the CoinDesk article, in addition to tens of billions of dollars of value held by Trump entities, there could be over $2 trillion held by Trump entities in not only the $Trump and $Melania memecoins, but others named after Eric, Don Jr.’s daughter Kai, and J.D. Vance.

On-chain data shows that the TRUMP treasury wallet currently holds $35.5 billion of the token, plus $17.5 billion in other memecoins named after Trump family members including Eric Trump and Kai Trump. The wallet flagged as having launched Official Trump has $622 million in the token and almost $162 billion in other coins, including $147 billion another memecoin named after Vice-President J.D. Vance. Unlike the Trumps, Vance did not indicate on social media that he was launching a memecoin.

Update January 22, 2025: Note that the estimate of $2.3 trillion in the article above is based on the fully diluted value (FDV) which is the total value of a cryptocurrency project if the total supply of all tokens were in circulation at a current price point. This article by Molly White provides a detailed overview of the how the math used to calculate crypto wealth is often based on flawed and unrealistic assumptions and the importance of providing context.

While the memecoins are the latest crypto grift Trump is using to profit off of regular investors, his first big public foray into a crypto venture was last year with World Liberty Financial. And World Liberty was not going to be left out of the grift; there was a flurry of new transactions related to World Liberty on inauguration day.

The Trump supported crypto project World Liberty Financial launched last year

Last year Donald Trump and his sons promoted a new cryptocurrency venture called World Liberty Financial (WLF) which sold WLFI tokens. Donald Trump, Eric and Don Jr. do not work directly for WLF, but they were listed on this SEC filing as ‘promoters’ and reportedly could take home 75% of the net revenue. According to reporting last year, a paper on World Liberty said that:

Trump and his family assume no liability. It indicates that none of them are directors, employees, managers or operators of WLF or its affiliates, and said the project and the tokens “are not political and have no affiliation with any political campaign.”… WLF’s paper says that a Delaware-based company named DT Marks DEFI LLC, which is connected to the former president, is set to receive three-quarters of the net protocol revenues.

World Liberty Financial is run by Chase Herro (aka Hero) and Zachary Folkman who, like many Trump business associates, have an illustrious past, including a history of unpaid debts, taxes and lawsuits. Coindesk reported that team members including Zachary Folkman and Chase Herro listed in World Liberty Financial’s white paper, had previously worked on Dough Finance, which was drained of $2 million in a hack last July. Folkman previously founded Date Hotter Girls LLC and taught classes on how to “Become the Ultimate Alpha Male.” Herro has spoken openly about his “past stints in prison for drug-related charges.”

Trump friend and property developed Steve Witkoff introduced Trump to Folkman and Herro. Witkoff is Trump’s special envoy to the Middle East and was involved in the recent ceasefire and hostage deal with Israel and Hamas.

Chinese-born Tron founder Justin Sun is the largest investor in World Liberty Financial

Last November, Justin Sun became the biggest investor in the Trump-supported World Liberty Financial crypto project. Cointelegraph reported that Justin Sun had purchased $30 million of tokens and he was also named as an advisor to World Liberty Financial.

Justin Sun was born and educated in China. In 2017 Sun founded Tron DAO, a decentralized blockchain-based operating system. In 2018 Justin Sun graduated from Hupan University which is located in Hangzhou, Zhejiang, China and was founded a few years earlier by Jack Ma, the founder of Alibaba Group. Jack Ma presented Justin Sun with his diploma, and after graduating Sun focused on Tron which had offices at the time in San Francisco, Singapore and Beijing.

In 2023 the Securities and Exchange Commission charged Justin Sun and his companies (Tron Foundation Limited, BitTorrent Foundation Ltd., and Rainberry Inc. formerly BitTorrent) for fraud and other securities law violations. Eight celebrities, including Lindsay Lohan, Jake Paul and Akon were also charged with illegal touting of Sun’s crypto asset securities (many have since settled). In March 2024 Sun tried to have the suit thrown out arguing the SEC had not established that the court had jurisdiction over foreign defendants including Sun and two companies based in Singapore.

Justin Sun founded Tron while in school in China and the filings in the SEC case establish that he is based outside the U.S. So it is very notable that he built his business starting in China and is now the largest investor in World Liberty Financial which provides revenue for Donald Trump.

On January 19th, the day before the inauguration, Justin Sun posted on X that Tron was increasing the investment in World Liberty Financial by an additional $45 million, bringing their total investment to $75 million.

On January 20th, World Liberty Financial announced on X that to commemorate the inauguration of Trump they were making purchases of over $112 million. The purchases included $4.7 million of Justin Sun’s Tron (TRX) and $47 million of wBTC, or wrapped Bitcoin, which is closely linked to Justin Sun.

Last summer, BitGo announced that it was moving its wBTC business to a multi-jurisdictional solution created by a joint venture with Justin Sun’s BiT Global, and that Sun’s BiT Global would be the majority partner in the operation. Sun’s BiT Global is described as a global custody platform with regulated operations based in Hong Kong.

Last December, Coinbase moved to delist wBTC and said in filings that Justin Sun posed an ‘unacceptable risk’. In response, Justin Sun’s BiT Global filed a lawsuit claiming Coinbase was improperly favoring a competing asset.

But in a 25-page response, Coinbase said the decision had everything to do with Justin Sun, the crypto billionaire and founder of the Tron blockchain, who is also accused of fraud and market manipulation in the United States. Sun became associated with wBTC via a partnership announced in August, according to Coinbase’s filing.

After Justin Sun posted on Monday that wBTC was the President’s choice for BTC, wBTC surged in price, and per this article was trading again on Coinbase.

While Donald Trump has entered the White House claiming to be tough on China, it is ironic–but not surprising given Trump’s ability to lie to the public–that the largest investor in the World Liberty Financial crypto project that Trump benefits from financially is Chinese-born Justin Sun, who launched his business Tron in China and has been sued by the SEC and is considered a risk by some industry players.

In addition to Justin Sun there is another person with past business ties to China connected to World Liberty Financial

Last November I wrote this story on Emerdata, one of the last surviving Cambridge Analytica entities run by Rebekah Mercer, and a former Emerdata director Sandy Peng, who is now advising World Liberty Financial.

Sandy Peng had been a director of Emerdata for a few months in 2018 and had worked for several years for businesses run by Johnson Chun Shun Ko, who was a close business partner of Erik Prince and both co-founded Chinese-based and part Chinese government-owned Frontier Services Group. Sandy Peng worked until early 2021 at Fission Capital, which was run by Rongson Teng, a close associate of Johnson Chun Shun Ko and a small investor in both Emerdata Ltd and Frontier Services Group.

Interestingly, around a decade ago Johnson Chun Shun Ko ran investment firm Reorient Group, later renamed Yunfeng Financial Group, where Jack Ma was a founder and investor. This was around the same time that Jack Ma launched the school attended by Justin Sun and where Sun launched Tron. However there is nothing indicating that Johnson Ko (or Sandy Peng) have any direct connection with Justin Sun.

Emerdata Ltd is now run by Rebekah Mercer who co-founded 1789 Capital with Omeed Malik and Chris Buskirk, the anti-woke investment company that recently hired Donald Trump Jr.

Trump will be a chaotic presence in the White House, and much of that chaos is purposeful and meant to confuse the public and the media and to obfuscate some of the most egregious actions that Trump’s administration will take. Much of the chaos will also obfuscate the egregious profiteering that Trump, his family and associates will pursue as the Trump kleptocracy takes root. The past few days leading into the inauguration have shown that crypto is going to be a central part of how Trump and his circle will grow their wealth at the expense of the investing public and Trump supporters.